Argentina: A Story Of Economic Destitute

With the central banks reserves dwindling to an all time low, the Argentine government seeks assistance to stave off another sovereign default.

Recently there have been talks of de-dollarization sparking fear and apprehension among many in the West. President Luiz Inácio Lula da Silva of Brazil and President Alberto Fernández of Argentina spearheaded these talks, first with the proposed currency union between Argentina and Brazil, and now with moves to increase foreign reserves of the Chinese yuan. To an outside observer, they would be confused to learn that on July 14th, 2023 Argentina’s Central Bank announced it would be accelerating its sell-off of Chinese yuan to purchase U.S. dollars. However, Argentina is in an increasingly desperate state walking a fine line between paying its debt to the International Monetary Fund (IMF) and defaulting. Beijing provides Argentina with a much-needed lifeline keeping the country afloat amidst an increasingly worsening economic crisis.

2001: Economic Collapse

Argentina is no stranger to economic hardship. They began the turn of the millennia with quite a rough start. In December 2001/January 2002 Argentina plunged into a devasting economic crisis. The government partially defaulted on its public debt and abandoned its fixed exchange rate to the US dollar. In the 1990s faced with high inflation and stagnant economic output, the Convertibility Plan was introduced. This plan pegged the Argentine peso to the US dollar, severely limiting the Central Bank’s ability to manipulate/print more of the peso. While this brought short-term gains the peso became overvalued, making Argentine exports less competitive. The government's fiscal policy was extremely lax enabling the borrowing of mass amounts of money. Additionally, the Argentine government's access to foreign capital became limited due to factors such as the dot com crash and the Asian financial crisis. This all culminated in 2001/2002 when the government could no longer bear the weight of the looming financial crash. A sharp depreciation of the peso followed and overnight many Argentinians’ life savings became worthless. This crisis would shape the political and economic landscape we see in Argentina to this day.

(Photo: AFP)

The Pink Tide Reaches Argentina:

With many Argentinians reduced to poverty, the people demanded change. The Peronists quickly stepped in and answered the people’s call. Modern Peronism is a uniquely Argentinian political movement characterized by left-wing, nationalistic populism. The Peronists advocate for policies such as increased social welfare, a highly regulated labor sector, and the nationalization of industries. The Peronists are hostile to Western influence and oppose any intervention in Argentine internal affairs. The Peronists dominated Argentinian politics from 2002-2015 and in 2019 they returned to power. What followed the Peronists' accession to power was immense government spending and subsequently large amounts of debt. Ever since 2008, the Argentine Peso has been devaluing, with massive inflation seen from 2019 to the present day. For 2023, the annual inflation rate is calculated to exceed 140%. For reference an item that would have cost 100 pesos in 1980 costs 902.38 billion pesos at the beginning of 2023.

(Photo: AP)

A New Ally Emerges:

Due to the Peronists' hostility towards the West and the increasingly worsening economic situation, Argentina was forced to look elsewhere for allies. Beijing seized the opportunity and began to invest heavily in Argentina. The Chinese see Argentina as a strategic ally for a few reasons. Argentina is rich in natural resources that China needs, this includes minerals such as Lithium, natural energy such as petroleum, and agricultural foodstuffs such as soybeans and meat. Beijing also would like to establish a foothold in the Americas to counterbalance the US and its allies in East Asia. In return, Argentina received immense investment, increased bilateral trade, and most importantly Chinese loans. While this Chinese investment staves off a financial crisis, it trades political sovereignty for short-term economic stability.

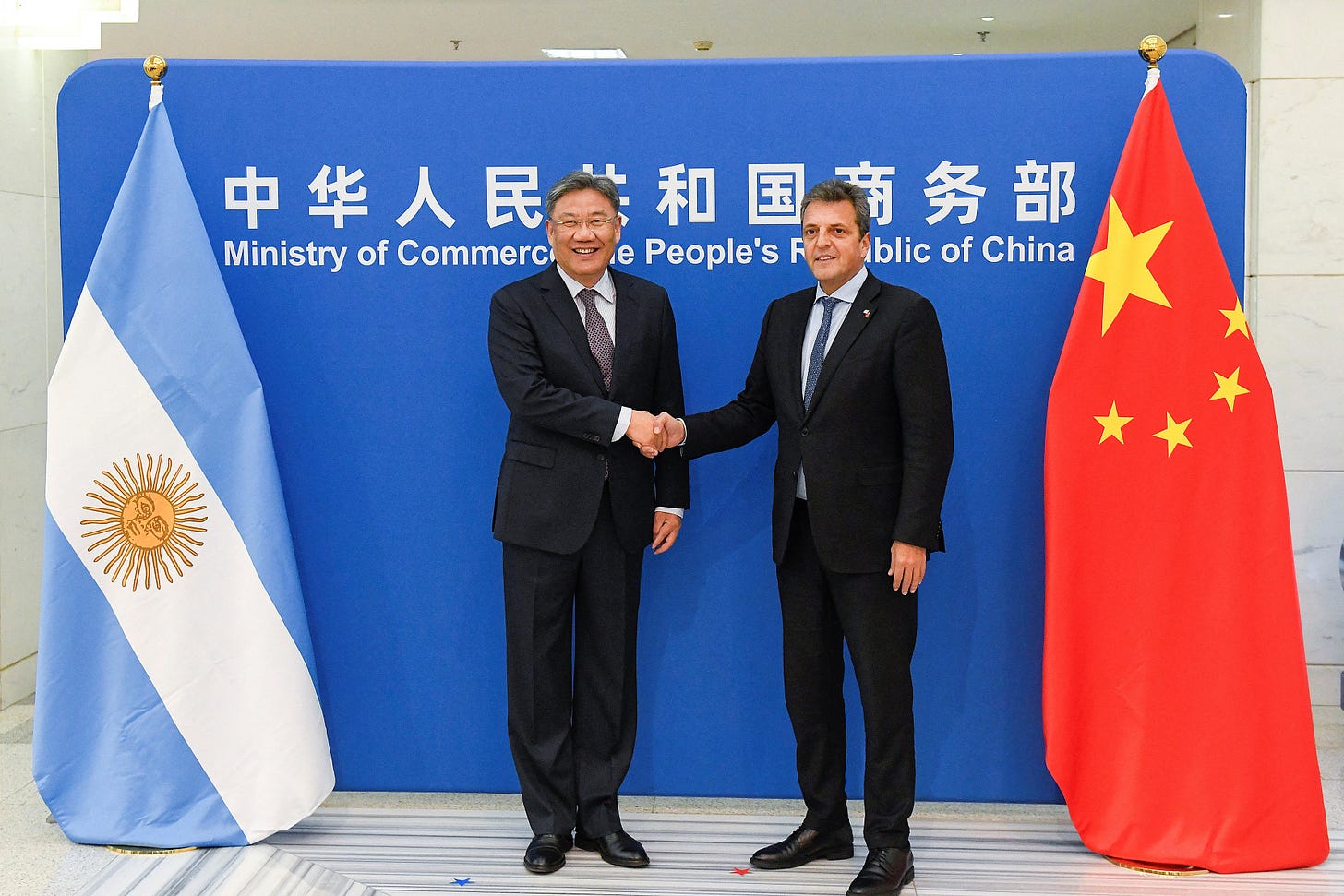

A Trip To Beijing:

Argentina’s Economic Minister and Presidential candidate for the upcoming presidential election in October 2023, Sergio Massa, went to Beijing in June 2023, to discuss strengthening economic ties between Argentina and China. During his visit, Massa met with a number of Chinese officials, including Vice Premier Liu He, Commerce Minister Wang Wentao, and National Development and Reform Commission (NDRC) Vice Chairman Ning Jizhe. Massa signed numerous memorandums of understanding spanning across many sectors. These MOUs include energy cooperation, cooperation regarding the Belt and Road Initiative in Argentina, and financial cooperation. Massa also met with numerous Chinese Business leaders to attract more direct investment. However, the most impactful outcome of this meeting was an agreed expansion of the currency swap line. In April 2023, China and Argentina announced that a currency swap line was established. This gave Argentina the ability to use the equivalent of $1.04 billion in Chinese yuan to pay for Chinese imports for the month of May. This was extended to over $18 billion worth of Chinese yuan over the duration of the next three years after the June meeting in Beijing. The Central Bank of Argentina said this increased the amount of Chinese yuan available for use from about $5 billion worth of yuan to almost $10 billion worth of yuan. This gives the Argentine Central Bank much-needed breathing room.

(Photo: Argentine Ministry of Economy)

Selling Off Currency Reserves:

The currency swap line between Beijing and Buenos Aires enables the Argentine government to change its domestic market dynamics. Instead of using the U.S. dollar, the central bank can sell the yuan to national companies so that they can import Chinese goods. This allows the central bank to retain some liquidity in US dollar reserves. The Argentine newspaper La Nacion reported that Argentinian central reserves dipped to historic lows. Just from January 2023, to July 2023 the reserves dropped by $18 billion. The country’s reserves are expected to drop even further with expected payments to the IMF. The central bank is frantically selling off vast amounts of yuan at a steep loss. On July 11, 2023, the central bank sold 770 million yuan for just $9 million, at a $98 million loss. This strategy allowed the Argentine government to barely meet the payment to the IMF that was due in June.

Looking Ahead:

This desperate strategy by the Argentine government may have kept the country afloat temporarily, but it is not a long-term solution. Just in the month of July, the Argentine Central Bank sold half of its available yuan. U.S. dollar reserves are expected to drop as low as $8 billion by the end of August. Negotiations between the IMF and the Argentine government resulted in the renegotiation of the terms of its $44 billion loan agreement. These negotiations were primarily focused on adjusting the schedule of disbursements from the IMF and easing economic targets as drought devastates agricultural exports. The economic crisis in Argentina has given the People's Republic Of China an excellent opportunity to develop its investment flow into Argentina and cement its influence in the country. Argentina is quickly losing its autonomy to make strategic decisions as it is increasingly at the mercy of Beijing and the IMF. As the country moves closer to its presidential election in October 2023, the political and economic stability of the country is coming into question with each passing day. Confidence in the currently ruling Peronist government is also at a low. After the libertarian populist candidate, Javier Milei came out on top in the presidential primaries, the value of the peso collapsed. The current economic minister and presidential candidate, Sergio Massa stated that “August has been one of the worst months... of the past 30 years for Argentina's economy.” Inflation for the month of August hit 12.4%, the highest figure since 1991. It remains to be seen if the election of a new administration can save the country from total ruin.

References:

Alcoba, N. (2023, July 17). Argentina’s Yuan Lifeline sign of brinksmanship between China, US. Business and Economy News | Al Jazeera. https://www.aljazeera.com/economy/2023/7/17/argentinas-yuan-lifeline-sign-of-brinksmanship-between-china-us

Argentina Foreign Exchange reserves. Argentina Foreign Exchange Reserves, 1956 2023 | CEIC Data. (2023). https://www.ceicdata.com/en/indicator/argentina/foreign-exchange-reserves

Goschenko, S. (2023, July 13). Central Bank of Argentina accelerates yuan sales and dollar purchases as reserves dwindle. Bitcoin News. https://news.bitcoin.com/central-bank-of-argentina-accelerates-yuan-sales-and-dollar-purchases-as-reserves-dwindle/

Hamid, J. (2023). Argentina’s central bank in crisis mode with yuan and USD. MSN. https://www.msn.com/en-us/money/markets/argentina-s-central-bank-in-crisis-mode-with-yuan-and-usd/ar-AA1dRTW5

Inflation rates in Argentina. Worlddata.info. (2023). https://www.worlddata.info/america/argentina/inflation-rates.php#:~:text=The%20inflation%20rate%20for%20consumer,rate%20was%20206.2%25%20per%20year

Perfil, R. (2023, July 16). El Yuan, en busca de un lugar en el sistema financiero argentino. Perfil. https://www.perfil.com/noticias/economia/el-yuan-en-busca-de-un-lugar-en-el-sistema-financiero-argentino.phtml

The role of the IMF in Argentina, 1991-2002, Issues Paper/Terms of reference for an evaluation by the Independent Evaluation Office (IEO), July 2003. International Monetary Fund. (n.d.). https://www.imf.org/external/np/ieo/2003/arg/index.htm#:~:text=Argentina%20was%20plunged%20into%20a,and%20political%20and%20social%20turmoil

Thomson Reuters. (2023, September 16). Argentina government expects economic rebound, inflation slowdown in 2024. Reuters. https://www.reuters.com/world/americas/argentina-government-expects-economic-rebound-inflation-slowdown-2024-2023-09-16/#:~:text=The%20South%20American%20nation%20is,the%20highest%20figure%20since%201991.

TOVAR, J. (2023, September 13). Argentina monthly inflation highest in three decades. Barron’s. https://www.barrons.com/news/argentina-monthly-inflation-highest-in-two-decades-c3b90f82