El Sur: The Currency To Challenge The U.S. Dollar?

Argentina and Brazil jointly announced preparations to create a common currency between the two nations to foster trade and reduce overreliance on the U.S. dollar.

After the election of Brazil’s leftist President, Luiz Inácio Lula da Silva a seemingly dead idea was resurrected: a common currency to be used across South America. On January 22, 2023, President Lula along with his counterpart in Argentina, President Alberto Fernández, jointly announced that both countries would start preparations for the creation of the Sur. The populist leftist leaders envision a common currency that would integrate and unite South America against overreliance on the U.S. dollar. However, it seems that their vision will remain as such; just a vision. There are numerous challenges that stand in the way of the creation of the Sur. Despite the near-universal dismal of such an idea of ever succeeding, it is still a significant indicator of Latin American discontent towards the United States and an interesting topic worth delving into.

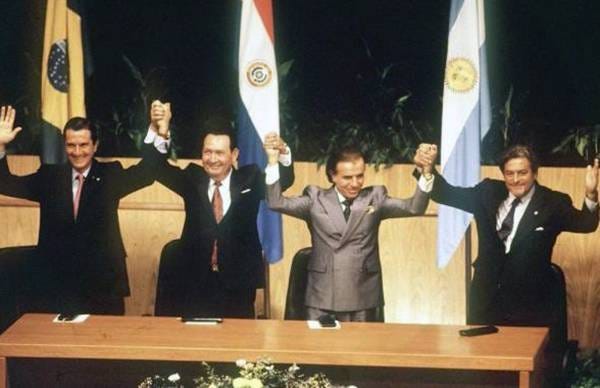

Argentina and Brazil are South America’s largest economies and have a shared history of efforts toward South American economic integration. In the 1990s, both countries were instrumental in the foundation of the Southern Common Market (Mercosur). Mercosur is a regional trade bloc that includes Argentina, Brazil, Paraguay, Uruguay, and Venezuela (Indefinitely suspended from the organization in 2016). Mercosur’s aims are to promote free trade and economic integration among its members, coordinate macroeconomic policies, and cooperate on social, cultural, and environmental issues. Since the signing of The Treaty Of Asunción in 1991, both Argentina and Brazil held numerous discussions to deepen economic integration, including the possibility of a currency union.

(Photo: La Nación Archive)

In the late 1980s, Brazil and Argentina discussed the idea of a shared currency for trade called the "gaucho," but the idea fell by the wayside due to its challenges. Again in 2019, former Brazilian President Jair Bolsonaro spoke of plans for a currency union, but those plans also never materialized. Political instability, economic divergence, and corruption are partly to blame for this. Additionally, Brazil has a more orthodox monetary policy, while Argentina has a more interventionist monetary policy. This difference in monetary policies could make it difficult to maintain the stability and trust to form a common currency. The Peronists (Argentina’s ruling leftist political party) are extremely nationalistic and prideful—many Peronists gaff at the idea of giving up their ability to control their own monetary policy. There simply was not enough political will to implement a common currency in the past.

This time the proposal made by President Lula and President Fernández is much more limited in its scope. Instead of replacing the currencies of Brazil and Argentina, the sur would be used in conjunction with them. The goal of the sur is to facilitate regional trade as well as reduce dependency on the dollar. The prevalence of the U.S. dollar as the primary currency for trade in the Americas is influenced by a multitude of factors, with proximity to and trade ties with the United States playing a key role. Additionally, less economically stable nations (such as Argentina) find that their own currencies lack recognition and stability on the international stage, making them unsuitable for use as a reliable means of payment or a store of value in global trade. Consequently, most businesses are often hesitant to engage in substantial transactions using a volatile currency. Furthermore, the adoption of the U.S. dollar is advantageous because it allows businesses to align their costs and revenues in the same currency, particularly since finished goods frequently incorporate imported inputs priced in dollars. When a company's international competitors transact in dollars, there is a compelling incentive for that company to do the same, as it shields them from the price fluctuations that competitors who do not use dollars may face.

(Photo: The Rio Times)

The introduction of a common currency between Brazil and Argentina could offer a potential solution to this issue. Such a currency arrangement would address several challenges associated with the prevailing use of the U.S. dollar in the region. Firstly, it would provide both countries with a stable and recognized medium of exchange, making it more appealing for businesses to conduct trade in their shared currency. This would mitigate the unease linked to using volatile domestic currencies and reduce the reliance on the U.S. dollar. Secondly, a common currency would facilitate cost management for businesses in both countries, as they could more easily synchronize their expenses and revenues, enhancing financial predictability and stability.

If the sur is ultimately implemented, the road ahead would be difficult. Adopting a common currency would mean relinquishing monetary and exchange rate policies as tools for macroeconomic stabilization. In the case of Argentina and Brazil, they have not reached a level of integration that would make this process easy and nationalism is deeply rooted. Additionally, the relationship between Argentina and Brazil is highly unequal. Brazil is the much larger partner in the relationship in terms of economic size and military strength. Argentina’s economy is highly unstable and is in a state of crisis. I am sure many Brazilians do not want to tie Argentina’s economy to their own, risking spillover from Argentina into the Brazilian economy. Finally, this proposal ignores one key fact: both private and even official organizations/individuals prefer the U.S. dollar. Implementing a third new currency between Argentina and Brazil will not change the fact that people trust the U.S. dollar for its stability and legal/regulatory certainty. Without trust and confidence in the sur little benefit can be had from its implementation.

References:

Ayres, M. (2023, January 23). Explainer: What Brazil and Argentina’s “currency union” really means. Reuters. https://www.reuters.com/world/americas/what-brazil-argentinas-currency-union-really-means-2023-01-23/

BBC. (2016, December 2). Mercosur suspends Venezuela over trade and human rights. BBC News. https://www.bbc.com/news/world-latin-america-38181198

Crandall, B. (2023, February 13). The Sur makes more sense than you might think. Global Americans. https://theglobalamericans.org/2023/02/the-sur-makes-more-sense-than-you-might-think/#:~:text=On%20January%2022%2C%202023%2C%20Luiz,dollar%20and%20foster%20regional%20integration

Steinberg, F., & Otero-Iglesias, M. (2023, February 14). South America’s “common currency” is actually about De-dollarization. CSIS. https://www.csis.org/analysis/south-americas-common-currency-actually-about-de-dollarization